Contents:

According to the Small Business Administration , 99% of all businesses in New Mexico are small… My name is Gary and I have always been gifted in mathematics from a young age. I knew throughout high school and college that I wanted to stick to that area of expertise. I am an easy-going individual, but that doesn’t mean I don’t work hard!

The business is treated as a separate, non-organic, person in the eyes of the law and referred to as a business entity…. Access to an expert – A supportive opportunity to ask your burning questions outside of the virtual office hours. Group Work Sessions – Do the work alongside other business owners. In this FREE training, I go over the characteristics needed to become a great bookkeeper. It’s important that anyone considering bookkeeping as a profession watches this and is honest with themselves about who they are. We all want success, and making sure you’ve got what it takes on the front end before you launch a business, is crucial to making this a reality.

Academy

ACCT 2301 and ACCT 2302 will transfer to other State-supported colleges and universities that offer Accounting and/or Business Administration degrees. Be sure to verify transferability with the receiving institution. Midland College also offers workforce courses, such as ACNT for professional training and development. A bundle of courses to help you pick and choose what you need or want to learn about to grow and foster your business.

- Usually, bookkeepers in the United States do not have to be licensed or certified.

- We train individuals to start and grow their own successful bookkeeping business.

- Was really happy with results however client decided not to go with it as its to traditional approach as opposed to using modern ios and android apps.

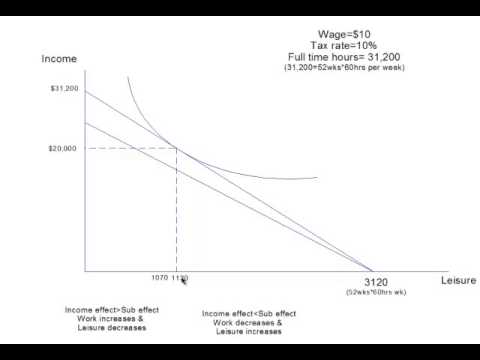

- This type of immediate updating of the general ledger account balances are called perpetual updating, as shown in the tables below.

- Online marketing can be especially impactful and allow you to reach prospective customers everywhere across the United States.

This free, online tool helps small business owners navigate the process of picking the right business structure for their new business. Because bookkeepers handle confidential information and financial data, clients will want to be sure they choose a professional who is knowledgeable, reliable, and trustworthy. Usually, bookkeepers in the United States do not have to be licensed or certified.

The Chart of Accounts (COA)

Starting a bookkeeping business requires paying attention to some essential legal and tax matters. To ensure you have accurate information, know what you’re responsible for, and understand how your decisions will affect you, seek professional advice from an attorney, accountant, and tax advisor. For those of you considering a bookkeeping business, I’ve listed many of the details you’ll need to address. This information is intended to give you a general sense of what’s involved and is not a substitute for professional legal, accounting, and tax advice. This stress-free virtual bookkeeping service is used by thousands of busy founders across the globe to accurately track their expenses and sail through the tax season. All businesses benefit from reduced expenses and since you’re not responsible for the online bookkeeping company’s overheads, your business doesn’t have to bear that cost.

Even if you have multiple people on staff that could help out, it’s ultimately going to hit everybody’s productivity. Once you move all of this over to an online bookkeeping service, you and everyone else on your team are free to focus on more important things. After spending several years as the founder of a small business, I realized how crucial a solid foundation is to a business. I found that many of the business owners I come across either have no idea where to start or lack the time to learn the correct ways to track their business.

Innovative Logo for E-Commerce Software Company

These outstanding checks can also provide an expert review of financial reports and CPA consultations so that you’re ready to tackle the tax season without much stress. Virtual bookkeeping services are very technology-forward. They utilized the power of the cloud in addition to advanced accounting software to provide 24/7 access to your financial records. All of the data is presented in powerful dashboards that let you dive deep into your finances, pull up detailed reports, and keep an eye on trends. You’re thus able to make informed decisions more quickly, no matter the time or day.

Obituary: Ronald L. Hogue – The Cullman Tribune

Obituary: Ronald L. Hogue.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

You are a trained and certified professional in your trade. Wouldn’t you want someone who is also a certified professional to care for your books? There are so many things that can go unnoticed or wrong in your business’s finances. I’m qualified to help you with solutions to these problems. Along with job experience in the fields of bookkeeping and accounting, I have graduated from Bookkeeper Business Academy and am also certified in Xero and QuickBooks accounting software. When it comes to looking after your finances, the life of your business, let me be the expert taking care of that.

ACCT101: Chapter 2: Business Transactions, Chart of Accounts, and General Ledger

We’ll provide you with a foundation for understanding accounting, business insurance, business formation considerations, and bookkeeping resources, so that you can stay in control as you grow. Online marketing can be especially impactful and allow you to reach prospective customers everywhere across the United States. Make sure that your website and LinkedIn profile showcase your education, credentials, and services. And please, upload a professional-looking headshot on LinkedIn. Clients will be far less likely to dig deeper into your profile if you use the shadowy default image as your profile picture.

The Southold Academy’s Place in North Fork History – Behind The Hedges

The Southold Academy’s Place in North Fork History.

Posted: Wed, 01 Jun 2022 07:00:00 GMT [source]

This is a 13-hour video course that includes quizzes for each section to check your knowledge. You can complete everything on your own time and you don’t need prior experience in accounting. AccountingCoach, LLC is a web-based educational platform founded in 2003 by Harold Averkamp. Averkamp is a certified public accountant who holds a masters in business administration and has more than 25 years of experience in the accounting field.

It’s time to overcome objections and limiting beliefs like

Obtain Business Licenses and Permits – Although no bookkeeper license is required, bookkeepers may have to obtain other licenses or permits to operate a business from their location. CorpNet can also help you identify which licenses and permits you will need. I will work with you and explain your financial statements and what the numbers actually mean. I will help show you some trends that could help to save money or point out situations where too much spending is occurring. I am organized and conscientious, so you can have peace of mind that your finances are in good hands.

You’ll find classes on general topics like starting a bookkeeping business and bookkeeping for small businesses, along with classes on specific accounting tools like QuickBooks, Google Sheets, and Excel. A virtual bookkeeping business run out of a home has relatively few startup needs. Still, there are equipment and technology tools you’ll want to invest in so that you can work productively and provide exceptional service to your clients. Determine What Contracts You’ll Need – As a self-employed business owner, it pays to make sure you protect yourself.

Full BioMary is a journalist with 14+ years of professional writing experience, her work has been published internationally by Forbes, HuffPost, Business Insider, The Points Guy, AOL, and SheKnows. He encouraged us all to get started before we felt ready. By the end of the course I had my website up , been blogging for a month, my opt-in freebie finished for list building, and I was actively marketing myself on Facebook and Twitter. I veered from the course a bit to find my target clients, but Ben really gave the blueprint. With the 5th lowest labor costs in the country, according to the newest WalletHub study, the “Land of Enchantment” state boasts a thriving small business community.

They are both happy to answer questions about the course and their careers. Ben was so helpful and his teaching style is really easy to follow. Our Facebook group was also really nice – having others to talk to about questions and for support was so helpful. I think it’s the fact that I had tried to learn bookkeeping on my own about a year prior and failed miserably because I had questions, but no one to ask. I watched his three free training sessions and just knew that I had to jump. I knew that I had to invest in myself if I was ever going to be successful.

The course is about 50/50 between bookkeeping skills and marketing skills. Much of the bookkeeping knowledge theory would be a waste, but the hands-on lessons are designed to help you get beyond theory and into application. Depending on how you were taught accounting, that could be a great asset.